Budget Planning for a less stressful New Year!

This year one of my main resolutions was to get control of my spending and start working my way out of debt. This task in itself sounds stressful but I knew that it needed to be done. I spent 2015 not thinking about debt and bills….not recommending that to anyone. It’s time to start getting a handle on my finances and budget planning was my first step.

Get a clear Debt Picture. The first step to my budget planning was to get a clear debt picture. I had to figure out where I stand financially. I collected all my bills and statements and wrote down exactly what I owed everyone. Yes this is the most depressing steps but it is the most important one. Once you know what you owe and what you are supposed to pay every month you can start working on budget planning for the month.

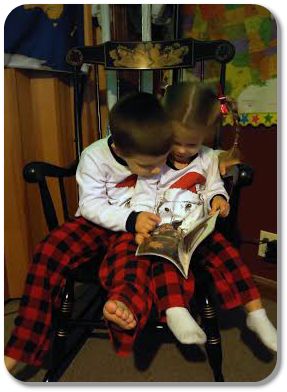

Find your “Why”. It’s important to have a tangible reason to stick to a budget. We’re going to Disney this year and I want my kiddos to have an amazing time. They are my reason to keep to my budget planning goals. They are the best “why” you can have. Once you find your reason it will be much easier to follow the next few steps.

Make Some Cuts! No one wants to think about cutting back but if you really want to get a handle on things, cutting back is necessary. Checking out ways to save on your utilities is also a great way to cut back. I know our Energy Bill is a really significant one each month. We’ve found that with simple changes we can save here. We changed bulbs and make sure we are shutting of lights and appliances not in use when we leave the room. You can also shop around for your energy company. With Direct Energy customers in Massachusetts save up to 30%* over National Grid MA’s electricity rate, and up to 8%* over Eversource’s electricity rate. That’s a great way to save and decrease the amount you’re spending each month!

It’s three weeks in and I’m pretty proud of the way it’s going. Yes, I’ve had to go outside the budget for things I hadn’t planned on. We all got sick and I hadn’t budgeted for extra cold medicine and supplies. I forgot that kids have birthdays we go to and things happen. Realistically, when you have kids things come up. With budget planning, I’m more aware of my debt and I’m actually working to get out of it (even with the small setbacks). I call that a great start to 2016!

*All savings refers to the current difference between Direct Energy’s fixed rate offer and the Utility’s current Fixed Rate for Basic Service as of January 8, 2016, and does not include any other component of the electricity bill. Utility rates are subject to change and there may be no savings following the respective official utility rate change date. Direct Energy’s fixed rates include electricity supply charges only and excludes delivery/transmission charges, taxes, and all other utility-related charges. Offer is limited and valid for new residential customers only.

Great tips on budgeting!! We all need a refresher at the beginning of the year to start it off on the right track!